The spread is how no commission brokers make their money. Main t alking points.

Currency Pairs And Spread Gemforex

Currency Pairs And Spread Gemforex

Traders pay a certain price to buy the currency and have to sell it for less if they want to sell back it right away.

Forex pairs spread. The pair is seeing a tightrope act today amid conflicting market cues. Costs are based on forex spreads and lot sizes. Next factor is amount of a deal.

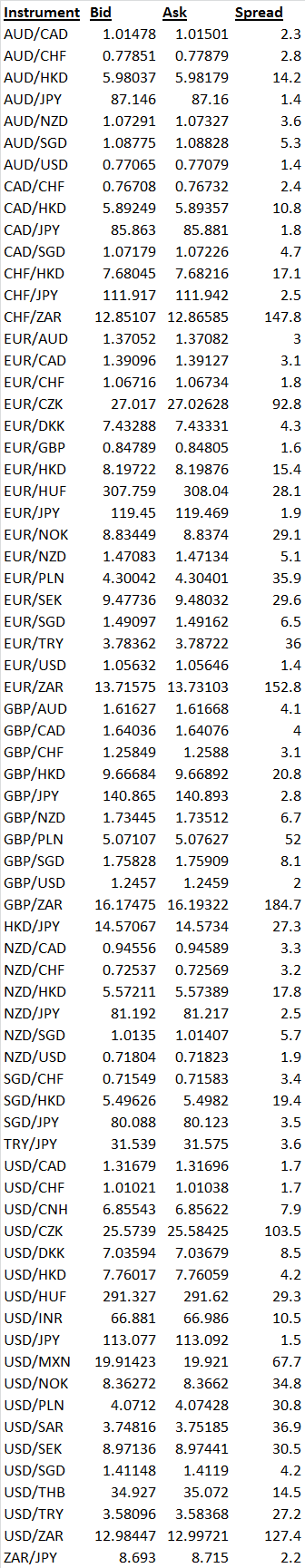

The buying bid price for a given currency pair and the selling ask price. The difference betwe! en these two prices is known as the spread. Spreads are based on the buy and sell price of a currency pair.

As in life the price for common things is lower compared to other more exotic and in demand. Forex trading is all about buying and selling currencies in pairs some more profitable than others. The ask is the price at which you can buy the base currency.

Sell off in forex market and us greenback own safe haven image from recent past continue to support usd in risk averse scenario. In forex the spread is essentially one part of the cost for you as a trader to open any trades. Here we look at some of the best currency pairs to trade.

The bid and ask price. Spread means spreading widening price range net amount. The forex spread represents two prices.

Forex brokers quote two different prices for currency pairs. When we compare the average spread to the average daily movement many inter! esting issues arise. Spreads will vary based on market conditi! ons including volatility available liquidity and other factors.

Middle size spot deals are executed on quotations with standard tight spreads. Typical spreads may not be available for managed accounts and accounts referred by an introducing broker. Extreme deals both too small and too big are quoted with broader spreads due to risks involved.

For example if the rate in us dollar yen is 10115 20 the spread is 5 sen. It counts into the total price of trading. Metatrader spreads may vary.

And the spread in forex is the price difference between the bid price bid and the selling price ask offer of the rate of the currency pair posted when performing forex trading. Forex spreads explain ed. First some pairs are more.

Popular currency pairs are traded with lowest spreads while rare pairs raise dozen pips spread. Spreads play a significant factor in profitable forex trading. The bid is the price! at which you can sell the base currency.

Why You Should Use Low Spread Scalping Strategies

Why You Should Use Low Spread Scalping Strategies

Forex Spread Definition And Explanation Forexabode Com

Major Currency Pairs What Are The Major Forex Pairs Ig Uk

Major Currency Pairs What Are The Major Forex Pairs Ig Uk

Bond Spreads A Leading Indicator For Forex

How To Trade A Synthetic Currency Pair And Why You Probably Shouldn

How To Trade A Synthetic Currency Pair And Why You Probably Shouldn

Vantage Fx Forex Broker Reviews

Currency Pair Correlations Forex Trading Octafx

Currency Pair Correlations Forex Trading Octafx

What Influences Bid Ask Spreads In Forex Trading Forex Training Group

What Influences Bid Ask Spreads In Forex Trading Forex Training Group

What Are The Best Currency Pairs To Trade In 2019

What Are The Best Currency Pairs To Trade In 2019

What Is Forex Trading Forex Trade Fx Markets City Index Uk

What Is Forex Trading Forex Trade Fx Markets City Index Uk

Forex Lowest Spread Pairs Lowest Forex Spreads

:brightness(10):contrast(5):no_upscale()/GettyImages-168304532-5902254b5f9b5810dc944eff.jpg) How To Understand The Forex Spread

How To Understand The Forex Spread

Forex Lowest Spread Pairs Lowest Forex Spreads

Pin By Franklin Global Capit! al On Spread Trading Forex Forex

Pin By Franklin Global Capit! al On Spread Trading Forex Forex

Forex Trading Singapore How The Bid Ask Spread Works

Forex Trading Singapore How The Bid Ask Spread Works

0 Response to "Forex Pairs Spread"

Posting Komentar